Understanding Actual Cash Value and Replacement Cost in Insurance Claims

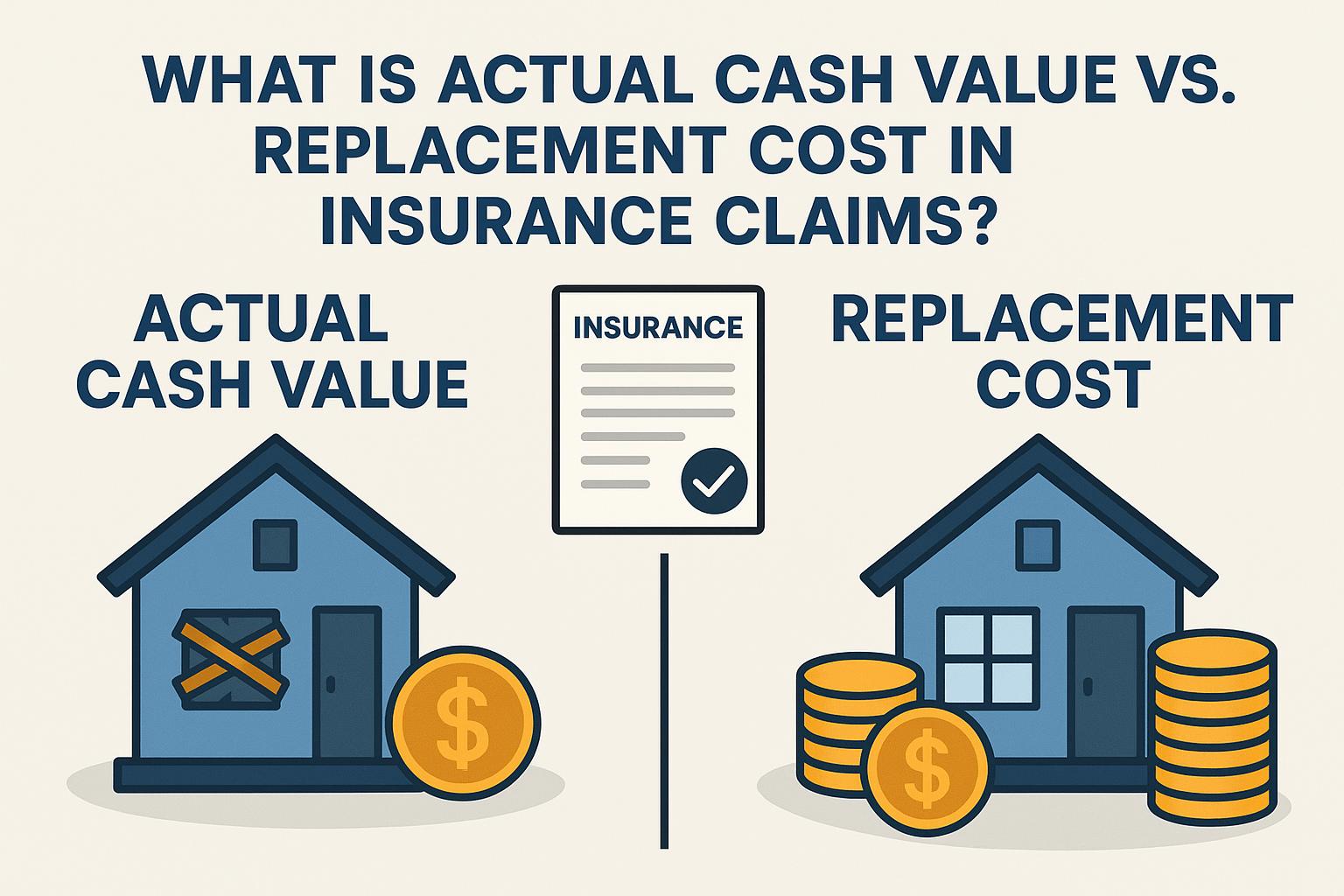

Navigating the world of insurance policies and claims can be complex, often involving various terminology and nuances that are crucial for policyholders to understand. Two key concepts that frequently arise during insurance claims are Actual Cash Value (ACV) and Replacement Cost. These terms represent different methods of calculating the compensation a policyholder is entitled to receive after a loss or damage. A clear understanding of ACV and Replacement Cost can immensely influence the outcome of an insurance settlement, impacting both the amount of compensation received and the financial position of the policyholder in the aftermath of an incident.

Actual Cash Value (ACV)

Actual Cash Value (ACV) is an industry-standard method for calculating the value of insured property at the time of a loss or damage. Essentially, ACV is determined by taking the replacement cost of an item and subtracting depreciation. Depreciation is a measure that reflects the reduction in an item’s value due to factors such as age, wear and tear, and obsolescence. The logic behind this calculation is to estimate the current market value of the item as opposed to its original purchase price.

Consider a scenario involving a personal belonging such as a five-year-old laptop. If this laptop is stolen, the insurance company does not simply reimburse the cost incurred at the time of purchase. Instead, they employ the ACV method to calculate the compensation. This involves determining what the laptop would cost brand new and subtracting the depreciated amount relevant to its five years of use. As a result, the compensation received under an ACV policy is typically less than what it would cost to purchase a brand new item of similar type and quality. The final payout reflects the laptop’s depreciated value at the time of loss.

Replacement Cost

In contrast, Replacement Cost insurance offers a different approach focused on enabling the policyholder to replace lost or damaged items with new equivalents. Under a replacement cost policy, the insurance covers the cost required to purchase a new item of like kind and quality, without subtracting depreciation. This type of coverage is designed to fully replace the lost or damaged property rather than compensating based on its depreciated value.

To revisit the laptop example, with a replacement cost policy in place, the insurance covers the full expense of purchasing a new laptop that is similar to the one lost. This approach ensures that policyholders can replace their belongings without having to pay out-of-pocket for the depreciation that the item accumulated during its lifespan. Thus, replacement cost policies typically yield a higher payout compared to ACV policies.

Choosing Between ACV and Replacement Cost

When evaluating your insurance coverage options, understanding the distinctions between ACV and Replacement Cost policies is vital. The decision between the two should be informed by considering several factors, such as individual financial circumstances, the importance of quickly replacing damaged or lost assets with new items, and personal risk tolerance.

Replacement Cost policies are generally characterized by higher premiums due to the insurance company’s increased exposure and the higher amount of reimbursement provided to the policyholder in the event of a claim. However, they deliver substantial peace of mind by guaranteeing that insured items can be replaced with new ones. Such coverage may be particularly advantageous for individuals and households who prioritize keeping their possessions updated and in optimal condition.

On the other hand, ACV policies typically come with lower premiums. This can make them more financially accessible but may involve an element of risk, as the payout might not entirely cover the cost of replacing a damaged or lost item with a brand new counterpart. Consequently, policyholders opting for ACV coverage should be prepared for potential out-of-pocket expenses when making a claim.

As such, selecting the appropriate form of coverage depends on personal priorities and financial goals. It is advisable to carefully review the specific terms and conditions outlined in each policy, as these can vary among insurance providers. Seeking advice from an insurance professional may provide further guidance to make an informed decision tailored to your specific needs.

Conclusion

Navigating insurance claims requires an awareness of how terms like Actual Cash Value and Replacement Cost influence potential settlements. Understanding these concepts empowers policyholders to make informed decisions regarding their coverage, aligning their choices with personal objectives and financial capabilities. Carefully analyzing individual requirements, considering the trade-offs associated with each type of coverage, and possibly seeking advice from a knowledgeable source can ensure a decision that effectively mitigates risk while safeguarding financial interests.

Expanding your understanding of these terms and their implications on insurance policies may include consulting with insurance professionals or researching trusted providers. Useful resources include relevant websites such as Progressive or State Farm, where further insights and details are readily available. Continually updating this knowledge empowers policyholders to effectively manage their portfolios, preserving their assets and enhancing strategy against unforeseen events.